Americans love SUVs, almost as much as guns, American flag-printed apparel, and hamburgers. For the record, I love hamburgers. But SUVs accelerate the destruction of the planet and the often destroy the bodies of other living things, humans and roadkill being the prime examples.

We set out to investigate whether SUV owners should pay some type of tax for their choice.

In order to say whether SUV owners should be required to pay an some type of surcharge (hint: we think they should), we have some preliminary questions to answer.

First, why would a consumer who wants an SUV deserve a surcharge? It is basically a tax. We tax things we want people to stop doing, or do less of. Especially something that is causing some harm to themselves or society.

In the case of SUVs, the harm we are concerned with is the planet and other living things.

But what does it mean for something to be bad for the environment? And how are SUVs bad for the environment?

Lastly, do green taxes even work?

Let us first talk a bit about what it means when we say something is bad for the environment.

What Does It Mean to be Bad for the Environment

In order to know whether SUV owners should be required to pay an energy surcharge, we need to have a good reason.

We only consider assigning a surcharge to SUVs because, evidently, we assume it is bad for the environment.

What does it mean for something to be bad for the environment? We mostly focus on ways you can reduce your carbon footprint. Including why composting is important or how choosing products made from recycled plastic or products made from recycled paper can fight global warming.

In Robin Attfield’s Environmental Ethics, he provides this rough definition of an environmental problem.

Environmental problems are problems that arise from human interactions with the natural world.

He lays out the types of environmental problems, including:

- Pollution

- Depletion of resources (including freshwater and fish-stocks)

- Degradation of land

- Loss of biodiversity (cultivars, wild species, and habitats),

- Global warming

He further clarifies that we care about the environment because, well, our lives depend on natural systems. And, the lives of our descendents will also depend on these same natural systems.

We can also get deep into the bowels of ethics and debate whether nature has value in itself. Whether we think the perspective of a plant is relevant to the debate. You can keep going, deep down into a rabbit hole of philosophy. But these questions are beyond the scope of this post.

Let’s just stick with a definition that focuses on the criteria above. Of the environmental problems above, we will mostly focus on global warming. And the fact that if we destroy this planet we will screw ourselves and all our descendants.

How are SUVs Bad for Humans

When we consider SUVs role in global warming, our primary concern is greenhouse gas emissions. However, many people take issue with SUVs for other reasons.

One issue is that drivers of SUVs tend to kill or maim humans in a more immediate way, by crashing into them with their excessively heavy vehicles.

As reported by the NY Times, each year, about 1.35 million people are killed in crashes on the world’s roads. Also, as many as 50 million others are seriously injured across the globe.

Lots of people die in car crashes in the U.S. too, more than most people think. You would think we would be more freaked out that cars kill almost 40,000 people a year.

And though it may be a random correlation, the rate at which people die eerily tracks the explosion of SUV sales in the U.S.

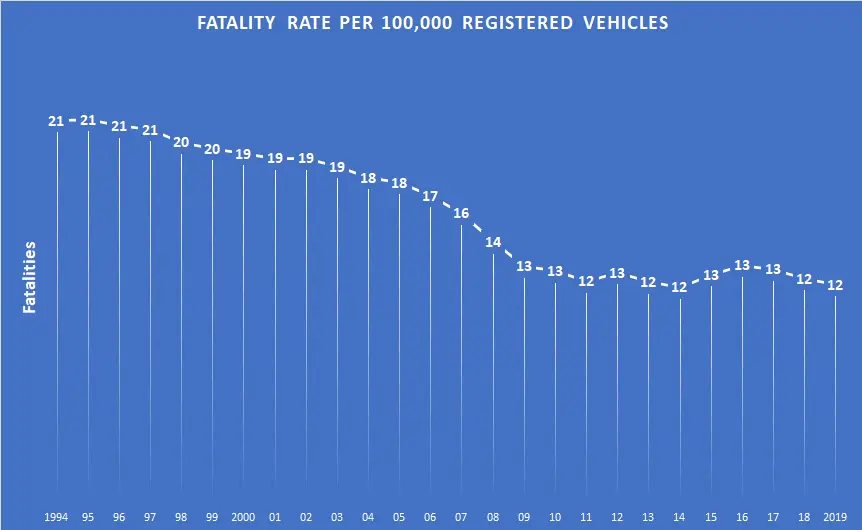

The U.S. had an amazing streak of sixteen straight years of decreasing fatality rates from 1996 to 2009. The fatality rate per 100,000 vehicles dropped 37% over that period.

Since 2009 the fatality rate has stopped its yearly streak of decreases, actually going up 3 years in the last decade. Also, the fatality rate decreased by 5% over those ten years, as compared to the 37% mentioned above.

Though we don’t claim any cause and effect, it is strange that so-called “light truck” sales in the U.S., which includes SUVs, have increased every one of those years from 2009 to 2019.

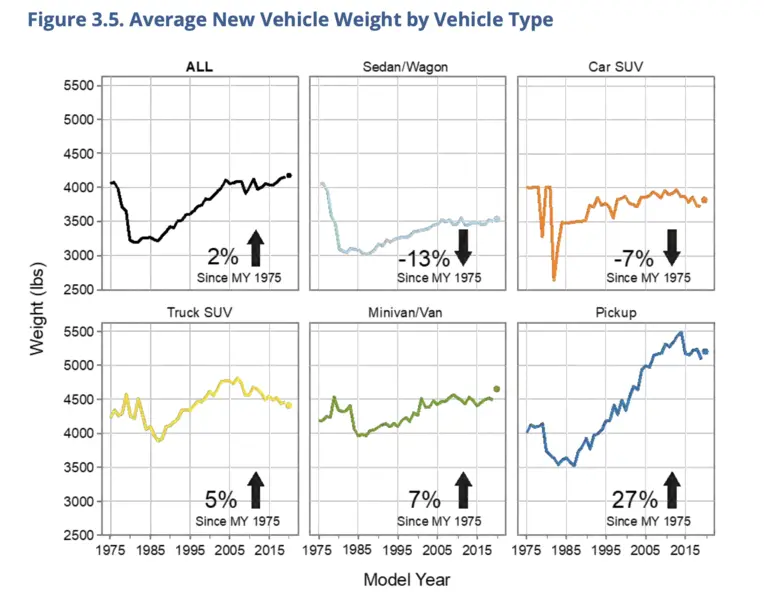

Interestingly, SUVs have roughly decreased in total weight since 2005 (note that so called “car SUVs” weight has remained pretty stable over that period). That said, SUVs are still a thousand pounds heavier than the average sedan and heavier than the average “truck SUV” in 1975. (See figure 3.5 in the EPA report on vehicle emissions).

And overall, vehicles have had a steady climb in average weight since 1985. That is generally bad for car crashes and the humans riding inside, or the pedestrians and bikers on the street. Evidently the Simpson’s classic “Canyonero” ridicule of large SUVs didn’t sway enough people.

But as the EPA points out, the greater a vehicle’s weight, the more emissions the SUV will spew into the air (unless it is electric of course). This leads us to how SUVs are bad for the environment and the case for why SUV owners should be required to pay an energy surcharge.

How SUVs are Bad for the Environment

Greenpeace has labeled car manufacturers “grotesque” for their oblivious embrace of bigger and bigger vehicles. Though I agree with the general sentiment, the data tells a more nuanced story.

A basic rule to remember here is a higher vehicle weight means higher carbon emissions. In 2019 the EPA reported that the average weight of vehicles hit an all time record.

After a precipitous drop in vehicle weight in the 1980, SUVs and trucks have pushed vehicle weights above how much they weighed in 1975. Car makers have wiped out all improvements that smaller vehicles like sedans made over those years.

That said, if you look at the chart above, you can see that trucks were a bigger culprit than SUVs – both “car SUVs” and “truck SUVs”. Truck SUVs are heavier than the baseline year of 1975, which is embarrassing given the advances in material science since 1975, but it pales in comparison to trucks’ 27% jump.

Car manufacturers have actually reduced truck SUV weight since 2005. But nonetheless, SUVs have followed a general pattern. Car makers have been increasing the weight of all vehicle types since the early 1980s.

SUVs and Global Warming

(see figure 3.7) The largest vehicles, trucks and SUVs that weigh over 6,000 lbs. spew almost 133% more emissions than lighter sedans. (eye balling the chart, top vehicle looks like 700 grams per mile and lightest is under 300 grams).

The International Energy Agency reported that during the pandemic carbon emissions for SUVs actually went up, despite a huge reduction in miles driven. Also, the increasing inefficiency of SUVs have wiped out the gains made from increased electric vehicles on the road.

Gas-guzzling SUVs slurped up so much oil in 2020 it is like all the electric vehicles purchased in 2020 didn’t exist.

At a time when the world’s scientists are screaming from the rooftops about the calamitous path we are on, it seems especially egregious for car makers and more importantly, car buyers, to keep buying bigger and bigger vehicles.

But marketing is effective and people are now convinced that “freedom” requires 5,000 lbs. of steel, four wheel drive, and enough storage capacity to pack-up your house.

How do we convince consumers to think twice about an SUV? Hit ‘em in the pocket.

Entering stage left, we get to our question (at last, right?!): should SUV owners be required to pay an energy surcharge?

Green Taxes: A Treehugger’s Version of Sin Taxes

Most people think of taxes, if they think of them at all, as an ever present annoyance where the government takes a cut of their earnings. People are generally aware that the government provides “services” with that money.

But taxes are also a tool well-meaning technocrats use to influence behavior. They add taxes to reduce certain behaviors and give tax breaks to promote other behaviors.

You are probably familiar with sin taxes, even if you haven’t heard that term. Sin taxes are defined as a tax the government adds to a harmful product, such as cigarettes or sugary drinks.

Green taxes, also called ecotaxes or environmental taxes, are like sin taxes. But green taxes encourage action to reduce environmental damage.

The Organization of Economic Cooperation and Development, better known as the OECD, gives a more detailed definition of a green tax. They say an environmental tax increases the costs of a polluting product or activity. The cost increase tends to discourage its production or consumption.

There are also environmentally motivated subsidies which reduce environmentally destructive behaviors.

If you stop and think about it, there are many green taxes in place today. The U.S. will give you a tax rebate for solar panels, electric vehicles, and energy efficient appliances. Another example is taxing coal. The U.S. government actually taxes coal, raising a quarter billion dollars in 2020.(As an aside, the U.S. comes in 39th out of 41 countries in terms of our revenue from green taxes).

Germany has already considered a sin tax for meat, increasing the tax on meat from 7 to 19%.

Declaring that SUV owners should be required to pay an energy surcharge would be similar to an ecotax on meat.

Charging SUV Owners An Energy Surcharge: Would It Work?

If you believe in the fundamental tenets of capitalism, then you should agree that increasing the costs for something would decrease its consumption. This assumes there is a reasonable substitute. In the case of a car shopper, a smaller SUV or bigger sedan.

Researchers found that the overwhelming majority of studies looking at the impact of sin taxes found a reduction in the targeted behavior (usually cigarettes and soda).

That said, designing effective tax schemes is complicated and rife with risks of unintended consequences. It is far from certain that an energy surcharge on SUV owners would work.

When gas prices go up, we get a natural experiment since SUV owners already pay an energy surcharge indirectly because SUVs are extremely inefficient. The NY Times reported that Google Searches for the term electric car hit a record in December 2021. This suggests car shoppers are sensitive to prices and will change their preferences if prices for some vehicles go up.

However, consumers also faced a car market squeezed by supply chain issues. Facing a shortage of choices, consumers might be looking to electric vehicles as an option.

SUV owners are charging themselves a pretty hefty energy surcharge because of the extreme inefficiency of their vehicles. If you own an SUV and have not slammed down your laptop lid in impatience for all our bashing of your car shopping choices (we love you by the way, sorry about this!), you can easily find out how big of an energy surcharge you have volunteered for.

You can find out how many more times you have increased your energy costs per mile relative to an electric vehicle using this slightly confusing chart from the Department of Energy to calculate energy costs per mile.

Let us assume a cost per gallon of gasoline of $3.50, a great deal at time of publication. We can pretend we get 18 miles per gallon in our magnificently huge beast of a vehicle. You will have “surcharged” yourself a 633% higher cost for energy per mile. Ouch!

Green Taxes: Advantages and Disadvantages

Green taxes, ecotaxes, and environmental taxes (and sin taxes) have one major disadvantage – they can increase costs for the people least able to pay. This is typically called a regressive tax.

Most researchers believe that taxes should be progressive in the sense that as you move up the income scale, your taxes go up. Income taxes generally work like that.

However, some sin taxes and possibly green taxes, work in the opposite way. Low income families tend to drink more soda, eat more fast food, and smoke more cigarettes.

You could imagine an energy surcharge on SUVs also impacting low income people more. We imagine the government would include all heavier vehicles, like trucks, in this surcharge scheme. Many people in the skilled trades and construction buy trucks because their jobs depend on hauling stuff.

If an energy surcharge made gas-powered vehicles more expensive, the costs could trickle down to the used car market as well.

Consumers face higher upfront costs with electric vehicles, though over the lifetime of the vehicle they are cheaper. However, lower income folks might not be able to afford that higher upfront cost.

Purely speculative, but we can imagine some unintended consequences from an energy charge on SUVs. What if it incentivized keeping older vehicles on the road longer?

A consumer faced with a higher price for a replacement SUV might put extra effort into keeping it running. That would reduce the rate at which electric vehicles are replacing gas-powered vehicles.

We are seeing a variation of that now with the supply chain issues in the car market. Drivers are choosing to repair rather than replace vehicles because of higher costs for a new or used car.

One Advantages of Green Tax is They Can Work

Norway is a fascinating illustration of how green taxes can work. Car buyers in Norway choose electric vehicles at an astoundingly high rate.

In March 2022, over 90% of vehicle registrations were electric. Norway also happens to have some of the most aggressive green tax incentives for electric cars.

Now to be clear, we have not studied Norway and there could be many other factors driving Norwegians to buy electric cars. Maybe they feel guilty about how much oil they export, coming in 10th in the world? The U.S. comes in 3rd but evidently we have no conscience.

The bottomline is governments have limited options to address environmental problems, especially ones as tricky as emissions escaping from tailpipes.

Car emissions are a classic market failure. When you buy a car you are paying for all the materials and labor that went into building it, marketing, etc. You pay for the gas that goes in the tank.

But who pays to clean up the pollution you cause? Should the car maker pay, they designed the vehicle? Should the gas station or the oil company pay? How would you even assign the cost to one of those players without taxing it.

Someone choosing to purchase an inefficient SUV, and the company that made it, impose costs on everyone and everything. And without green taxes, no one has to pay for the damage, at least in dollars.

But a bill will come due someday in the form of a climate catastrophe. And we are sticking our descendants with that bill.

The advantage of green taxes is pretty simple, we do not have any other options besides relying on people’s willingness (and ability) to voluntarily choose less polluting behaviors. Basically doing the right thing out of the goodness of their hearts.